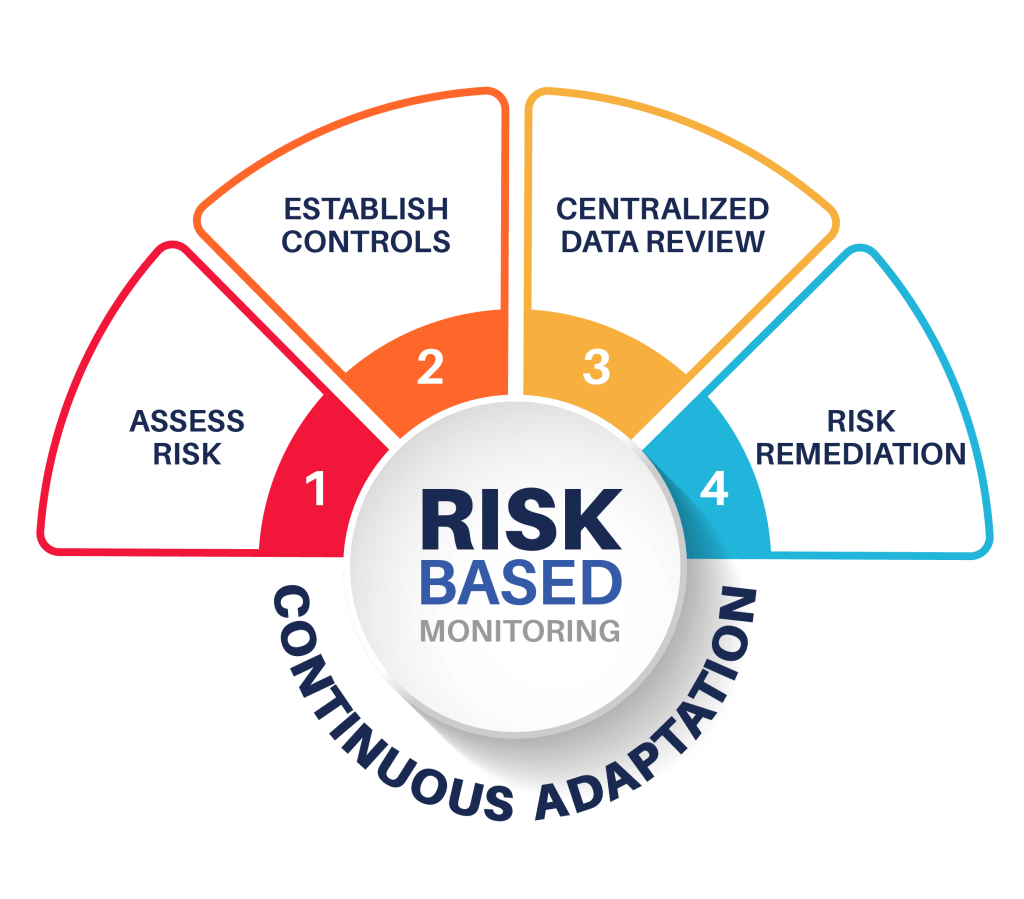

Risk-based monitoring approach encouraged Amalgamated Security Services Limited to engage in a comprehensive and systematic process to pre-emptively manage the risks associated with its operations.

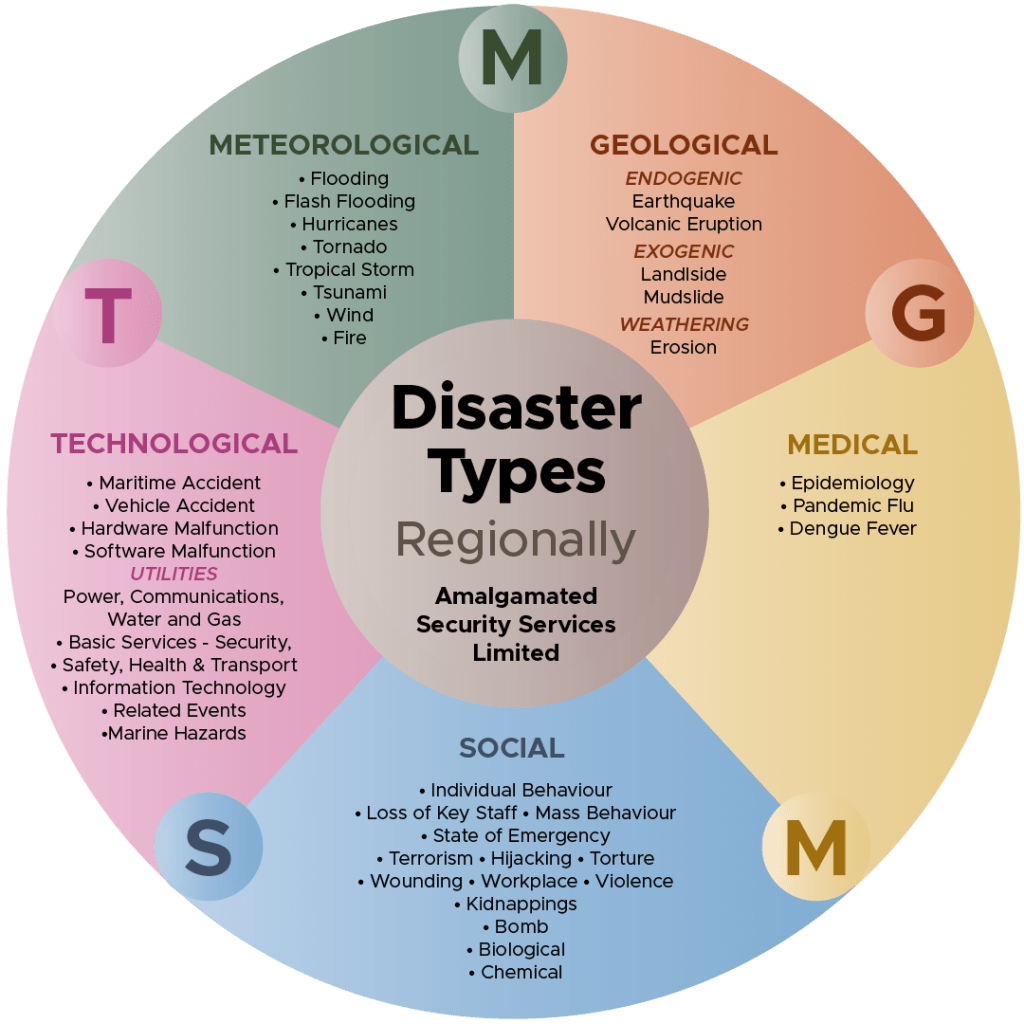

Amalgamated Security Services Limited has adopted a rigorous approach to disaster planning. We have developed a comprehensive Crisis Management and Business Continuity Plan that covers the five (5) spheres of disaster. (Refer to Disaster Planning Section – Resource Library).

We conduct both emergency and crisis drills quarterly with top management and staff in preparation for response to natural and man-made disasters.

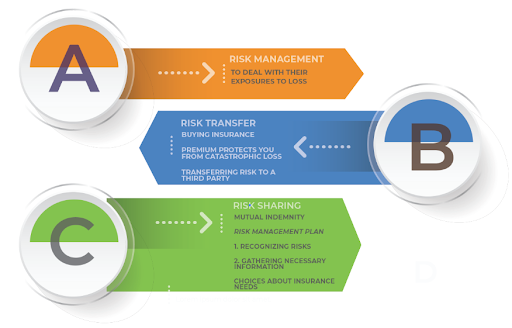

Amalgamated Security Services Limited utilizes external insurance to protect its balance sheet against risks that have the potential to cause a significant financial impact. Our risk appetite is important to us in that it aids in the protection against unforeseen events.

Our investigations unit adopts a proactive approach to claims management by conducting risk assessments at clientele locations to determine whether it is within a high or low-risk region. The unit also analyses claims and incidents to provide positive recommendations for improvement of client’s security programs.

The listed types of insurances below are important to our enterprise risk management portfolio:

You cannot copy content of this page

Javascript not detected. Javascript required for this site to function. Please enable it in your browser settings and refresh this page.